But all that added value is going to the capital investors, while the workers are getting screwed.

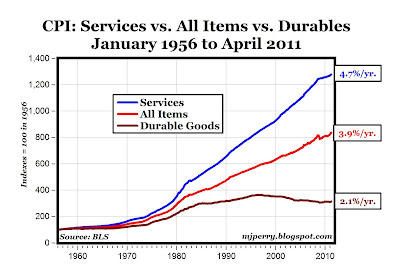

False. Take a look at my post directly above this one. Workers (as consumers) benefit with more affordable manufactured goods available for purchase as their price drops in real terms. In other words, we all benefit from the price drops that result from the additional competition or the increase in productivity.

Do you know the areas that have had ridiculous increases in price over the last 50 years? Education, health care, and housing, exactly the areas shielded from foreign competition and outsourcing. If you look at where the vast majority of the additional capital income share has gone, it's gone to real estate owners. In part due to restrictive zoning and other development regulations (making quality real estate far more scarce).

Rognlie shows that the share of net income generated by housing has risen in all seven large developed economies since data became available. “Housing’s central role in the long-term behavior of the aggregate net capital share has… not been emphasized elsewhere…Observers concerned about the distribution of income should keep an eye on housing costs,” he writes.

Another thing you fail to consider is that while capital share of income has risen, net capital share of income is the more important metric to consider. This means that we must subtract depreciation from the capital share of income to get a true picture of how much income capital owners are receiving. Imagine I purchase a machine for $100,000. If this machine breaks down after 4 years, meaning I have to buy a new one after the 4 years is over and reinvest another $100,000, this machine must earn me over $25,000 per year additional profit to be a worthwhile investment. On the other hand, if this machine breaks down after 10 years, then I only need to increase profit by over $10,000 per year to be worthwhile. If the 4 year machine can increase profits by $30,000 pear year and the 10 year machine can increase profits by $20,000 per year, then the 10 year machine is actually more profitable per dollar of investment. However, notice that the more profitable investment would actually have a _lower_ share of overall income.

If the economy shifted more so to the 4 year machines (faster depreciating capital), the capital share of income would rise in the data and yet capital owners would not be better off.

What does the data actually say?

Capital income is not growing unboundedly at the expense of labor, and further accumulation of capital in fact most likely means a fall in capital’s share of total income – refuting one of the main theories of economist Thomas Piketty’s popular book Capital in the 21st Century — according to a paper presented today at the Spring 2015 Conference on the Brookings Papers on Economic Activity (BPEA).

Existing studies that show an increase in capital’s share of income miss the growing role of depreciation in short-lived capital, in items such as software, says MIT’s Matthew Rognlie in “Deciphering the Fall and Rise in the Net Capital Share.” Rognlie subtracts depreciation in seven large developed economies (the US, Japan, Germany, France, the UK, Italy, and Canada) to get net capital income, and finds that the only long-term rise in capital’s share of income is in housing. Capital income elsewhere in the economy has grown moderately, but it is only recovering from a large fall that lasted from 1948 through the 1970s.

http://marginalrevolution.com/margi...gnlie-on-piketty-net-capital-and-housing.html

The problem with your system is that it doesn't value the human beings involved in it, it only values the profitability of the production/consumption cycle. When worker Bob loses his job while CEO Steve gets a big fat bonus for getting more productivity out of fewer workers (breaking unions, ending pensions, eliminating benefits, etc.), your system thinks this is a success. And so, not surprisingly, do the CEOs the capital investors.

You are failing to take into account that more goods/services become available for purchase in our economy as a whole when these things happen as each worker produces more product per hour.

The negatives you mention can be offset with greater safety net programs, which will be far more affordable given the greater economic prosperity and the increase in incomes. Taxes, federal state and local, currently amount to about 33% of total GDP. Unless you want to argue that government spending doesn't provide us value, society automatically captures 33% of any additional value created in the economy through greater tax revenue. This is on top of the more affordable prices that result for consumers.