If we basically slash our tax burden down from 35% to 5%

No, it would be from greater than 50% to 5%. The income of the average citizen would literally double.

our revenues will drop by like two-and-a-half trillion USD down to an amount that wouldn't even fund the VA.

Yes, it would require getting rid of all the stuff that the government does that is not its responsibility, which is ONLY infrastructure and criminal justice (both foreign and domestic).

That includes getting rid of the VA department.

5% income tax would easily fund anything to do with infrastructure and criminal justice.

We're not going to do that to our veterans, nor to ourselves.

The government doesn't have the right (as a government) to take care of people, except for providing infrastructure and protecting the innocent from criminals.

That's not what God says to do.

God says "Do not steal."

Socialist programs (such as the VA) violate that rule.

I disagree with your opinion here of what my writing will 'lead to'.

Lowering debt will not happen when you increase the burden on the people, it only wears the people down so that they don't produce as much. Think of it this way, the more downward pressure you add to a wheel, the harder it is for it to turn. Tax is a downward pressure on the people. The more tax you burden the people with, the harder it is for them to function.

Accountants and tax preparers and tax attorneys get a lot of money from the current system.

Yes, and?

I'm aware of the arguments.

You don't seem to be.

In case you didn't read the articles linked, here are the 10 arguments made by Bob to Neal Boortz and to Ken Hoagland against the National Sales Tax (the following comes from

https://kgov.com/writings/national-sales-tax-debate-bob-vs-top-advocates)

1. No right of conscription.

The government does not have the right to force a businessman to become a tax collctor, something that millions rightfully hate.

2. The FairTax continues confiscatory taxation.

Bob Enyart argues that the biggest problem with taxes in America is the horrendous amount of money taken. Regardless of how it is taken and of where the money comes from, giving absurdly vast tax revenues to a bloated socialist government is like giving heroin to an addict. Ken agreed with that lesser point, but he missed Bob's bigger point. "You're rearranging the deck chairs on the Titanic when you change the method of confiscatory taxation but continue to rob the country of trillions of dollars."

3. Fraud enticement to strangers.

A sales tax entices millions of strangers, who briefly meet, to conspire together to defraud the government, fueling an illicit underground economy with far more interactions between individuals. Why? Because we all buy and sell from a hundred times more people than we employ. This systemic encouragement for strangers to conspire to defraud the government makes a terrible impression on the children who grow up around such transactions and it generally undermines respect for government itself.

4. Start-up impediment.

A sales tax makes it far more difficult to enter into business, especially for the poor, the young, and those with less business sense. Not only do they have to meet all the demands of operating a competitive and profitable business, but the government forces them, for each transaction, to calculate a sales tax, to collect the tax, to segregate those funds, to resist temptation to use those funds in emergencies, to remit those funds, and to keep records of all those transactions.

5. Vastly greater transaction cost.

There are a billion sales transactions per day, but vastly fewer income tax transactions, which means that there is a far greater transaction cost to a sales tax than to an income tax. So the cost of processing 400 billion sales tax transactions per year is more than processing perhaps four billion income tax transactions per year.

6. Conflict of Economic Interest.

Government will obsessively encourage spending and borrowing, rather than increased incomes, saving and investment.

7. To not tax the poor hurts them.

Families earning under $30,000 annually should be able to walk down the street with their heads held high. However, the Fair Tax completely exempts those earning less than $27,000 from paying any tax, and so they will not have ownership in our society. The poor need to pay the same percent, as they will with a flat income tax, the same as everyone else, especially to build their own self respect.

8. You don't need a sales tax to eliminate the IRS.

A flat income tax does not require a tax collection agency. People can simply remit their taxes, just as a hundred million households currently pay their rent, utilities, cable bills, etc., and as businesses under an unjust sales tax would remit taxes. People are people, whether they own a business or not. Just do away with the IRS.

9. It's the UnFair Tax.

Paying a 22% sales tax on new goods is grossly unfair comparing the middle class to the poor and the super wealthy, with the unfair burden falling disproportionately on the middle class, as it often does with creative economic proposals. With the "FairTax", lower income households pay no taxes. The super rich, who easily spend only a small percent of their income, get taxed only on that small percent of their income. Whereas, the middle class gets taxed on approximately half of its income, much of which is effectively non-discretionary spending necessary for survival.

10. God did it.

The Scriptures record God's solution to the problem of equitably and efficiently collecting revenue from the entire population for a centralized fund. God implemented a flat income tax of ten percent to fund the operations of the priesthood.

They can be addressed and still have a national uniform sales tax.

Not without violating Biblical principles or putting an unnecessary burden on the people.

There's problems with only taxing income too.

And yet, as the last argument above says, God still implemented a flat income tax.

Not like tax work. That's a lot of work.

See point 8 above.

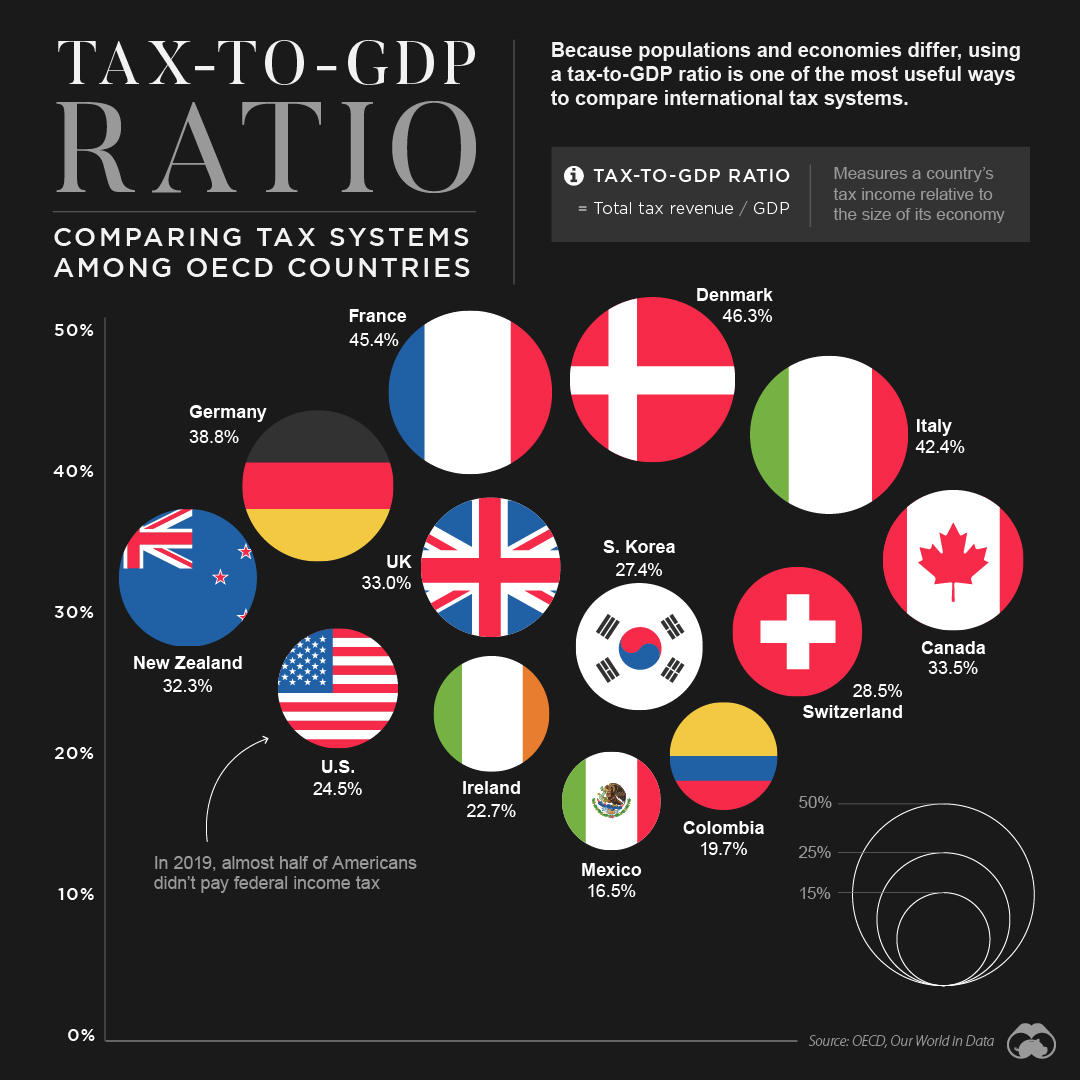

www.visualcapitalist.com

www.visualcapitalist.com