I'm not sure of where I stand on this because while someone may be 21 it doesn't mean they understand economics or what they are doing to themselves a student loan debt is pushed at them hard. Did they take on contracts to repay? Yes, but at the same time they didn't understand the consequences of their actions.

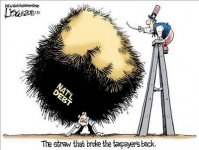

The same thing has been done to a lot of adults with the manipulation of interest rates. As soon as the bubble bursts and interest rates rise they are forced out of their homes and often into bankruptcy. No matter how deep their ignorance of finances is I have to feel for them as our learning institutions have all failed them by not teaching them practical economics and they are constantly bombarded by our corrupt media as to how it is their "right" to go deeply into debt for the "American dream".

The psychopaths in banking, government, and media are just beyond their ability to understand.

I have more to add to this. Let's say we have 2 students looking to get a student loan. One is a computer science major the other is a fine arts major. Potential income for a computer science major can run from $100,000 t0 $250,000 a year. A fine arts major is going to earn maybe 1/4 of what the computer science major is going to earn. However both are offered the same ability to borrow as all either of them are required to show is acceptance into a college/university.

If both were working in their chosen professions the fine arts major is not going to qualify for anywhere near the size of a loan the computer science guy will. Their credit is based upon their income. So why as students can they both borrow the same amount of money? That is predatory lending at it's worst. It's something only a psychopath would do to another human being as it is cruel beyond imagination. That fine arts guy is going to be impoverished for the rest of his life while the computer science guy may struggle some right out of school his lifetime earnings are such that he will pay off his loan and retire with a hefty retirement fund.

Why are there no protections for the student borrowers written into the legislation as kids are the most vulnerable borrowers to manipulation that there are? The only protections are for lenders and government and once you take a federally guaranteed loan you cannot get out from under it other than through becoming disabled and having no earning power at all, and then your case is reviewed every 5 years for life.

The injustice of this really bothers me.